For Insurers

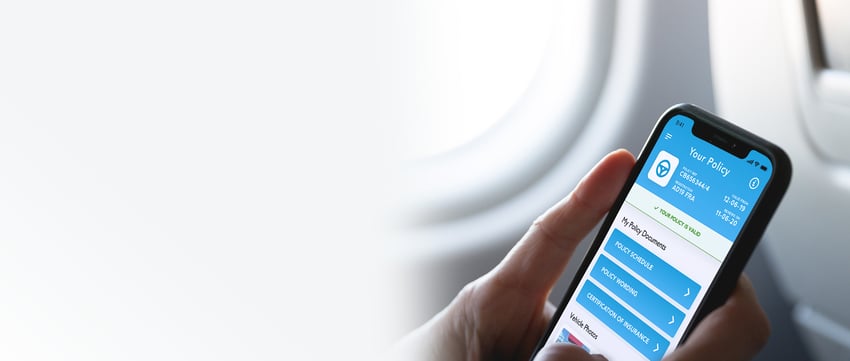

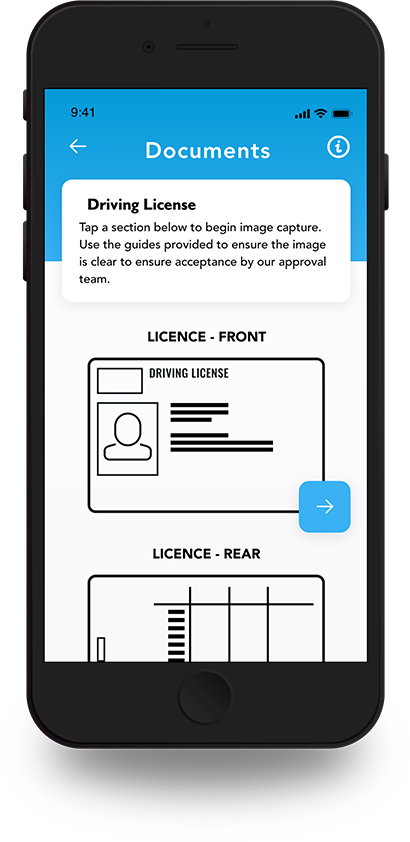

Validate allows you to move your customer on-boarding process away from costly manual processes onto a highly accurate and fully digital smartphone based solution. The app can be customised to support your specific policy type allowing it to guide your customer step by step to photograph all of their key documents.

Our platform automatically checks image quality, the document type and it performs optical character recognition (OCR) on the documents to verify customer details or identify inaccuracies. Check vehicle condition, vehicle history and access driver endorsements all via the app. We also perform AI analysis of the document and photo metadata to identify fraud. Inzura Validate allows you to be sure that you are signing up the risks you are expecting.

Validate can be integrated with any existing policy management back-office processes and the resulting reduction in fraudulent claims can provide up to 10-15% claims ratio benefit on direct or price comparison sourced business. It works for complex motor insurance policies but can be applied to travel, life, health and home insurance. For example, the app can be used to capture home insurance documents such as mortgage approvals or surveyor reports. It can also be used to catalogue high value items such as jewelry, watches or high tech items.